newport news property tax exemption

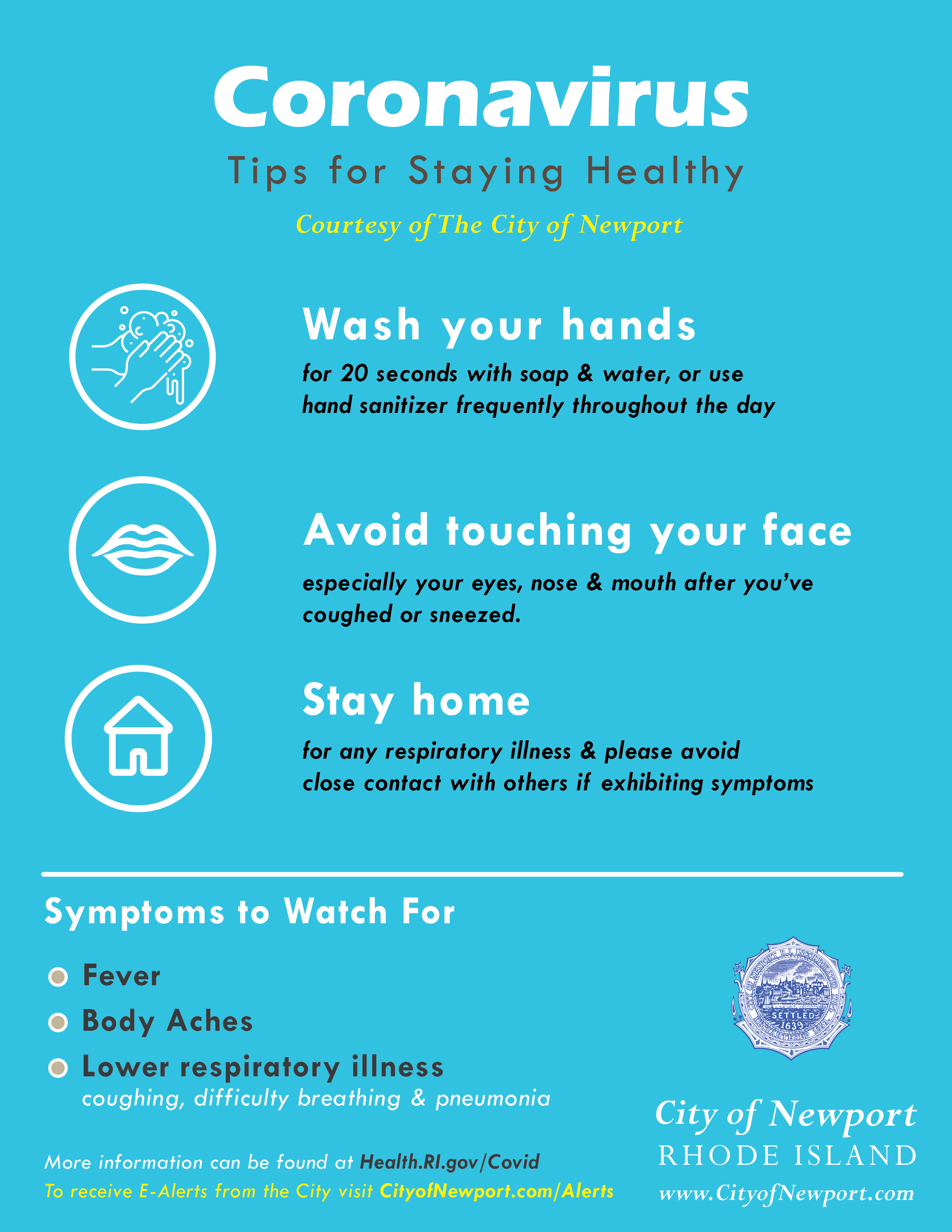

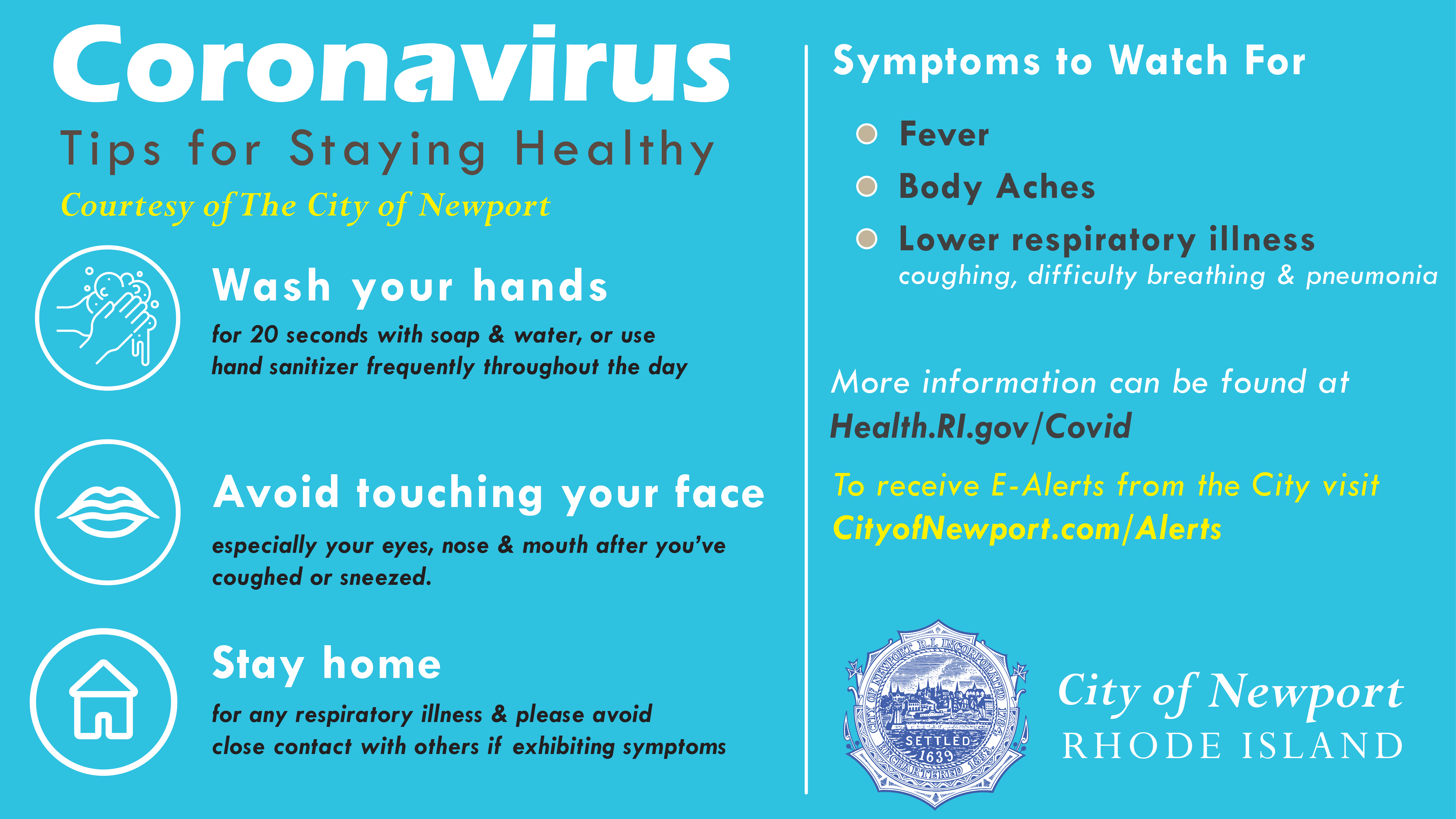

The Newport News City Homestead Exemption can reduce the appraised valuation of a primary residence before calculating the property tax owed resulting in a lower annual property tax rate for owner-occupied homes. Refer to Car Tax Relief qualifications.

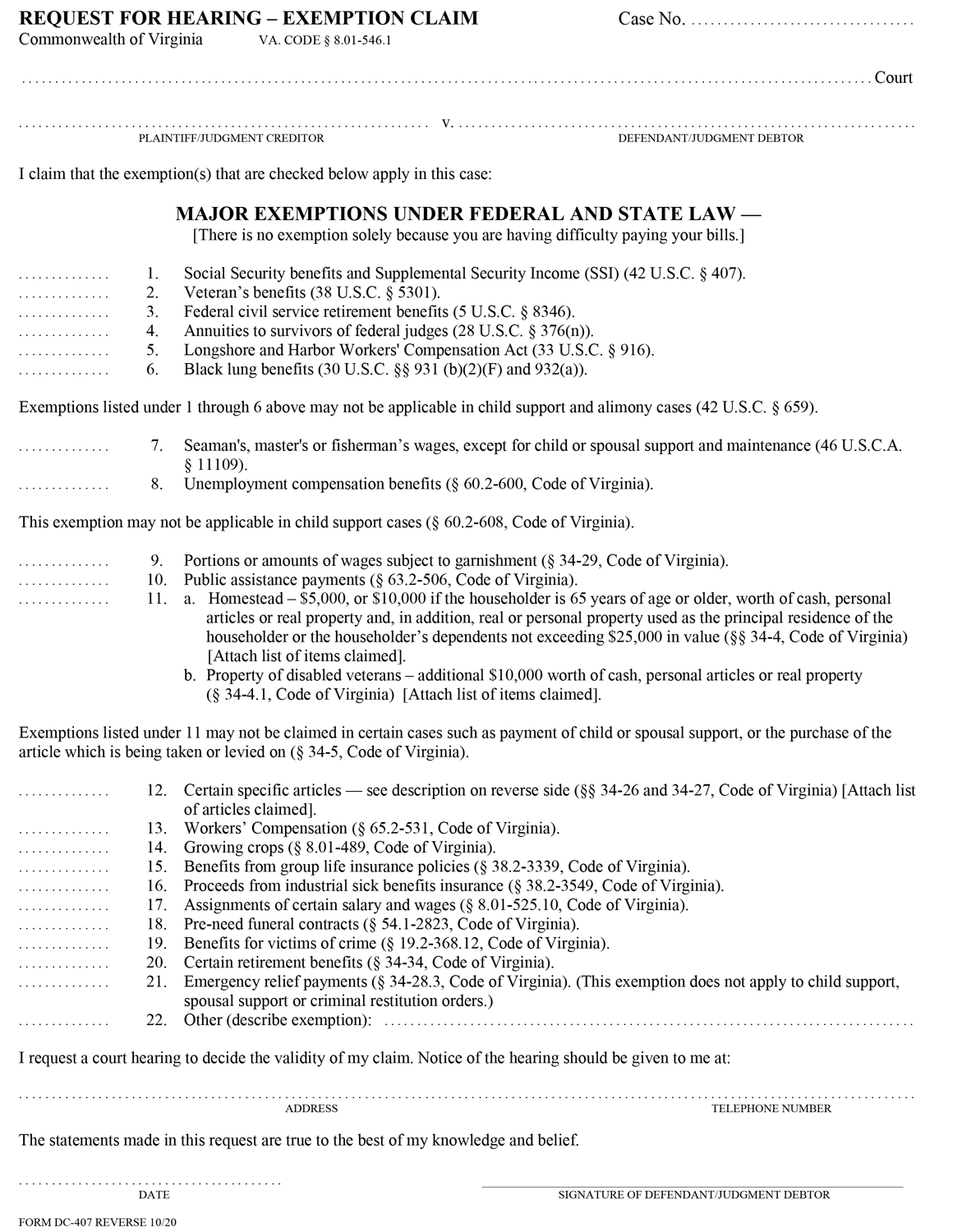

The Complete Guide To Garnishment Exemptions Law Merna Law

Loading Do Not Show Again Close.

. 757-247-2628 Department Contact Business License. 2022 Senior Citizen Exemption Form Application window is January 1st through March 15th. How Newport News Real Estate Tax Works.

Find information about tax relief deferral exemption and abatement. Learn how we calculate your vehicles discount for your personal property tax. Cold War Veterans Now Qualify for Tax Exemption.

Tax Appeal Form for Real Estate and Tangible Personal Property. Application window is August 5th through November 3rd. Along with collections property taxation includes two more common operations ie.

Application for Personal Property Mobile Home Tax Exemption for the Elderly. Newport News VA 23607 Main Office. Every entity then receives the assessment amount it levied.

Owners must also be given a reasonable notice of levy escalations. Taxation of real estate must. If Newport News County property taxes have been too high for your budget resulting in delinquent property tax payments a possible solution is getting a quick property.

More ways to connect. 757-926-8651 buslnnvagov Personal Property. If Newport News City property taxes have been too high for your wallet causing delinquent property tax payments.

When an automobile is licensed with out-of-state tags solely in the military members name a Newport News personal property return is not required. The Newport News City Council voted to switch from a tax exemption program to a deferral last year which means that instead of being exempt from property taxes lower-income seniors can now defer. Therefore if you file for a Real Estate Tax Exemption it will not be necessary for you to take any action or file a separate application for the Solid Waste Fee Grant Relief Program.

1 be equal and uniform 2 be based on present market value 3 have one appraised value and 4 be deemed taxable except for when specially exempted. 2022 Annual Return to the Assessor. Click here to contact the Tax Assessors Office.

However if you do not plan to apply for Real Estate Tax Exemption you must separately apply for the Solid Waste Relief by contacting the City of Newport News Call Center at 757-933-2311. Application Instructions PDF Other Forms. Personal Property Tax Relief Act The tax on the first 20000 of the assessed value of your qualified personal property will be reduced for tax years 2006 and forward.

Receipts are then dispensed to related taxing units via formula. One section says the Newport City Council is authorized to annually fix the amount if any of a homestead exemption with respect to assessed value from local taxation on taxable real property used for residential purposes The amount cannot exceed a 35 percent exemption for single-family homes and condominiums the provision says. Within those confines Newport sets tax rates.

757-247-2500 Freedom of Information Act. Newport News VA 23607 Main Office. Department of Veterans Affairs to have a 100 service-connected permanent and total disability and who occupies the real property as his or her principal place of residence.

Still taxpayers generally receive a single combined tax bill from the county. Taxing units include Newport county governments and a number of special districts such as public schools. The General Assembly hereby exempts from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US.

757-926-3535 taxreliefnnvagov State Income. Taxing districts include Newport county governments and a number of special districts such as public hospitals. Free Newport News Assessor Office Property Records Search.

757-247-2628 Department Contact Business License. If you are contemplating taking up residence there or only planning to invest in the citys real estate youll learn whether the citys property tax statutes are helpful for you or youd rather hunt for an alternative locale. 757-247-2628 Department Contact Business License.

The states give property taxation rights to thousands of community-based public entities. Appeal Rules for Real Estate-Tangibles. All property not eligible for exemption should be taxed evenly and uniformly on a single current market value basis.

You have several options for paying your personal property tax. Newport News VA 23607 Phone. If you are in the Armed Services not a resident of Virginia and are a full time active duty military member you may be exempt from the personal property tax and vehicle license fee based on your military status.

All property not falling under exemptions is required to be taxed evenly and uniformly on a single present market value basis. Tax Rates for the 2021-2022 Tax Year. For properties considered the primary residence of the taxpayer a homestead exemption may exist.

Explore how Newport applies its real estate taxes with our thorough guide. Find Newport News residential property tax assessment records tax assessment history land improvement values district details property maps tax rates exemptions market valuations ownership past sales deeds. Taxpayers rights to timely notification of rate raises are also obligatory.

Newport homeowners who served in the military during the Cold War period from 1947 until 1991 are now eligible to qualify for property tax relief through the Rhode Island Veterans Exemption. 757-926-8651 buslnnvagov Personal Property. For Tangible accounts for year ending 12312021.

Skip to Main Content. Click here to download an application. Suitable notice of any levy raise is also a requisite.

Establishing property tax rates and conducting appraisals. Veterans Certificate of Disability PDF. 757-926-8657 ppnnvagov Related Taxes.

For qualifying vehicles valued at 1000 or less your obligation to pay this tax has been eliminated for tax years 2006 and forward. Newport News VA 23607 Main Office. Scroll down to learn about how we determine the taxable value of property.

757-926-8644 brtxnnvagov Real Estate Tax Relief. They all are public governing entities administered by elected or appointed officials. There are three basic steps in taxing property ie formulating mill rates estimating property market worth and taking in payments.

732 Natalie Pl Enumclaw Wa 98022 Mls 1579313 Redfin

What Are The Taxes To Sell My Home In Nebraska

Protecting Assets When Filing For Bankruptcy John W Lee P C The Law Offices Of John W Lee P C

Are Houses Too Big Or In The Wrong Place Tax Benefits To Housing And Inefficiencies In Location And Consumption Tax Policy And The Economy Vol 28 No 1

Are Houses Too Big Or In The Wrong Place Tax Benefits To Housing And Inefficiencies In Location And Consumption Tax Policy And The Economy Vol 28 No 1

Property Tax Calculator League Of Minnesota Cities

Newport Ri City Council Oks Bill That Would Offer Split Tax System

11411 26th Dr Se Everett Wa 98208 Mls 1913114 Redfin

El Paso City Council To Discuss Lowering Property Tax Rate During Tuesday S Meeting Kfox

Raymond Hong Director Indirect Tax Otis Elevator Co Linkedin

Virginia S Outdated Homestead Exemption The Law Offices Of John W Lee P C

New York Governor Signs 2022 2023 Budget Marcum Llp Accountants And Advisors

The Complete Guide To Garnishment Exemptions Law Merna Law

Raymond Hong Director Indirect Tax Otis Elevator Co Linkedin